National Issues

Everything is Going Up—Except Our Hopes -By Ezinwanne Onwuka

For the average Nigerian, survival now means making tough choices—skipping meals, cutting back on necessities, or taking on extra jobs just to stay afloat. Families that once enjoyed a modest standard of living are now struggling to afford the basics. Many young people are forced to rely on their parents for support, while others are leaving or considering leaving the country in search of better living conditions.

When the federal government removed fuel subsidy two years ago, many Nigerians braced for tough times as this singular action triggered a ripple effect on virtually every aspect of life. Fuel prices skyrocketed and left many of us struggling to fill our tanks. Prices of goods and services shot up overnight. The cost of transportation doubled, businesses battled higher expenses, and inflation soared. As a matter of fact, survival has become a daily struggle with life becoming unbearable for many.

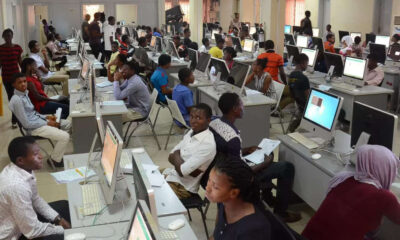

Yet, it does not stop at this. Just as we were adjusting to higher fuel prices, another bombshell dropped—massive increases in school fees. Many federal and state universities raised their tuition fees by over 100 per cent, citing inflation and the rising cost of running institutions. Some private universities also adjusted their fees to reflect the prevailing economic realities. Even primary and secondary schools jumped on the bandwagon.

This was a devastating blow to parents with multiple children in school. Many had no other option but to withdraw their children from private schools and enrol them in public ones. Some students in tertiary institutions have been forced to take up menial jobs or defer their studies because their families can no longer afford the outrageous tuition. With the current economic situation, education has become a privilege rather than a right.

Just when we thought things couldn’t get worse, there came the increase in electricity tariffs. Despite enduring an unreliable power supply and relying on alternatives like generators and solar energy, we are now compelled to pay even more for a service that remains inefficient. This has left many households and business owners with hefty bills to pay. For businesses that depend on electricity, this means higher operating costs, which are deliberately passed down to customers through increased prices. This affects the cost of everything from bread to haircuts, sachet water to tailoring services, cold drinks to frozen foods, and phone charging to printing and photocopying.

For many small business owners, the cost of staying open has become unsustainable. Some have reduced their hours of operation, while others have shut down completely. Tertiary institutions are struggling to offset their accumulated electricity bills running into millions of naira, with some universities cutting down essential services like water supply and internet access for students. As universities buckle under the financial strain, students and staff are left to bear the consequences of these economic pressures.

Another financial burden Nigerians now face is Automated Teller Machine (ATM) withdrawal charges. On 10 February, the Central Bank of Nigeria announced a revision of these charges, set to take effect from 1 March 2025. The most significant change is the scrapping of the previous policy that allowed bank customers three free monthly withdrawals on other banks’ ATMs. This means that every withdrawal on another bank’s ATM will now attract a fee. Under the new policy, customers withdrawing from another bank’s ATM will now be charged ₦100 per transaction for amounts up to ₦20,000. For withdrawals at off-site ATMs (outside bank premises), a ₦100 fee plus a surcharge of up to ₦500 per ₦20,000 transaction will apply. Meanwhile, withdrawals from on-site ATMs (within bank premises) will attract a ₦100 charge per ₦20,000 transaction. The CBN explained that the review is a “response to rising costs and the need to enhance efficiency in ATM operations in the banking industry.”

Since cash transactions remain a major part of our economy, this new policy has placed an extra financial burden on individuals and businesses. Those who rely on daily withdrawals to meet their needs are now forced to think twice before using ATMs. For small traders, who rely heavily on cash, the extra cost of making ATM withdrawals only worsens an already challenging economic situation. Ultimately, this policy means that even accessing one’s money now comes at a cost.

But that’s not all. Nigerians have been hit with yet another torturous blow – higher data costs. For years, buying data has been one of those necessary expenses we all complain about but still pay for without much of a choice. Every month, you set daily limits for your data usage and maybe even turn off auto-updates just to make your bundle last a little longer. But as of 20 January 2025, that routine got a lot more expensive as the Nigerian Communications Commission (NCC) approved a 50 per cent price increase for telecommunications services. The reason? If you guessed “rising operational costs”, you’re right! Justifying the move, the NCC said Nigeria’s telecom industry has been running on outdated pricing models since 2013 despite inflation, currency depreciation, and increasing infrastructure costs.

MTN Nigeria became the first to act on this approval. The multinational telecommunication company quietly updated its data plans, raising the cost of its 1.8GB monthly plan to ₦1,500, replacing the previous 1.5GB plan, which was ₦1,000. The 20GB plan has jumped from ₦5,500 to ₦7,500, while the 15GB plan now costs ₦6,500 instead of ₦4,500.

MTN is not alone in this. SWIFT Networks, a major internet service provider in Nigeria, has also increased its prices by 50 per cent, making home broadband connections significantly more expensive. And this is just the beginning—more price hikes are on the way. While MTN and SWIFT have already adjusted their rates, other telecom operators are set to follow. Airtel has announced that it will implement its increases gradually to ease the impact on customers, while Globacom is also expected to adjust its rates in the coming weeks. Meanwhile, it’s not just data costs that are rising—call and SMS charges are also increasing. The cost of sending an SMS has jumped from ₦4 to ₦6 across all networks, adding yet another layer of financial strain on Nigerians who rely on mobile communication.

The impact of these increases is far-reaching and devastating, especially as everything—food, electricity, transportation—keeps getting more expensive, and salaries aren’t keeping up for many. As a salary-earner myself, I can attest to the nightmarish living conditions in this economy. Every month feels like a battle to stretch limited earnings to cover basic needs, with little to no room for savings or emergencies.

For the average Nigerian, survival now means making tough choices—skipping meals, cutting back on necessities, or taking on extra jobs just to stay afloat. Families that once enjoyed a modest standard of living are now struggling to afford the basics. Many young people are forced to rely on their parents for support, while others are leaving or considering leaving the country in search of better living conditions.

The question on everyone’s lips now is: what’s next? Will food become even more expensive? Where is the country headed? The uncertainty is overwhelming. Many Nigerians are losing hope, while crime and insecurity continue to rise as desperate individuals look for ways to survive as the light at the end of the tunnel appears to be growing dim.

So, I ask: how much more can we endure?

Ezinwanne may be reached via ezinwanne.dominion@gmail.com.