Africa

Is it Just Me? I Always Feel Robbed, Cheated And Confused, Each Time I Leave Inflationary Market, by Isaac Asabor

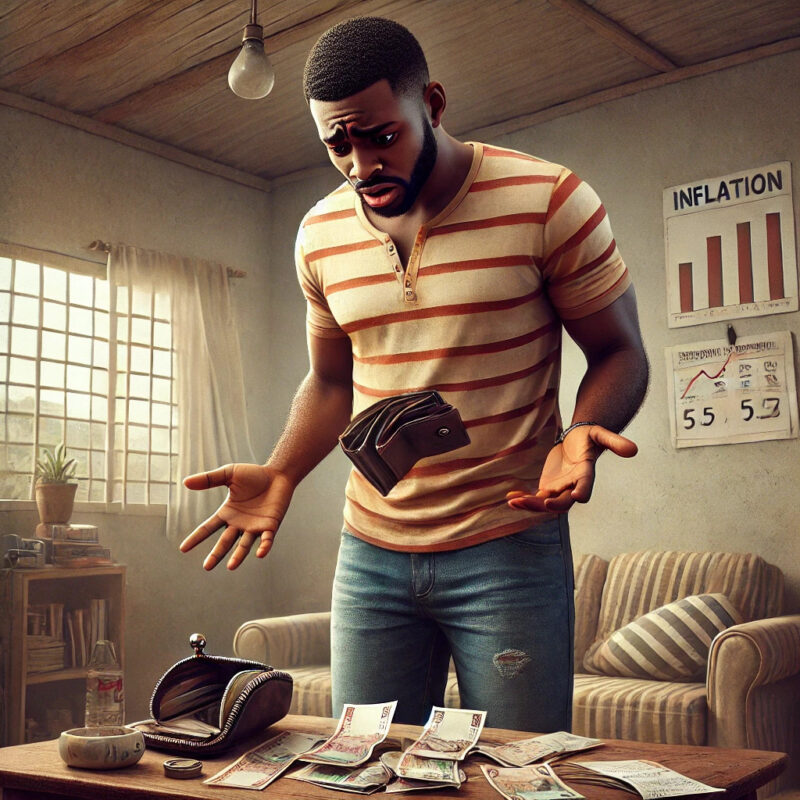

In a world where inflation seems to be the persistent background noise of daily life, it is no wonder many of us feel as if we are constantly being robbed. The soaring prices of commodities, food, and everyday essentials create an ever-looming sense of financial insecurity. Even when our wallets remain intact, the feeling of being cheated or lacking control over our financial well-being can be overwhelming.

Every day, we engage in the act of spending. A simple shopping trip can turn into a perplexing spiral of anxiety as we watch prices escalate before our eyes. What used to be a routine task suddenly feels like a daunting challenge, a gamble where the odds seem invariably stacked against us. You might leave the store spending a considerable amount, only to wonder if you were overcharged by a vendor or if certain items cost more than they should have. This pervasive fear, despite knowing you were not robbed, echoes in the minds of many Nigerians grappling with financial uncertainty.

Feeling robbed is not just a matter of physical theft; it is psychological. As inflation rises, the purchasing power of our money diminishes. What you could buy for a specific amount last year now requires significantly more. This erosion of value can evoke feelings of violation, similar to the emotions that arise from being robbed. You might ask yourself, “Where did my money go?” or “Was that price hike intentional?” These questions exacerbate feelings of vulnerability and distrust toward vendors.

As inflation takes root, it is easy to start suspecting that vendors are taking advantage of the situation. An increasing number of consumers report feeling skeptical about pricing practices. Whether it is at a bustling market or a local store, the fear of being overcharged emerges. You might find yourself questioning every transaction, lingering over receipts with a critical eye, wondering if you paid a fair price.

Social media can often amplify feelings of financial insecurity. With the constant flood of information on inflation rates, economic forecasts, and stories of struggling individuals, it is easy to feel a sense of collective loss. Images of empty shelves or exorbitant price tags circulate online, further fueling paranoia. “Is it just me?” becomes a common refrain shared among those grappling with economic pressures.

So how do we cope with this pervasive feeling of being robbed, even when no theft has occurred? Recognizing that such feelings are a common response to economic hardship can be the first step. It is essential to differentiate between emotional responses and reality. Engaging in transparent discussions about finances, seeking community support, or even practicing mindfulness can help ground us in the present.

Ultimately, acknowledging our feelings is crucial. Understanding that the fear of loss and the sensation of being robbed are valid emotional responses in these challenging times can foster resilience. It is not merely a personal struggle; it is a shared experience that many are navigating together.

In fact, while the waves of inflation cast shadows over our daily lives, leading us to believe we have been robbed, it is important to remember that these feelings are not unique. They arise from the broader context of financial uncertainty. By leaning into our shared experiences and supporting one another through these turbulent times, we can begin to reclaim our sense of agency, one transaction at a time.

According to Statista, a global data and business intelligence platform with an extensive collection of statistics, reports, and insights, “Nigeria’s inflation has been higher than the average for African and Sub-Saharan countries for years now, and even exceeded 16 percent in 2017, and a real, significant decrease is nowhere in sight. The bigger problem is its unsteadiness, however: An inflation rate that is bouncing all over the place, like this one, is usually a sign of a struggling economy, causing prices to fluctuate, and unemployment and poverty to increase. Nigeria’s economy – a so-called “mixed economy”, which means the market economy is at least in part regulated by the state, is not entirely in bad shape, though. More than half of its GDP is generated by the services sector, namely telecommunications and finances, and the country derives a significant share of its state revenues from oil.

“Because it got high, To simplify: When the inflation rate rises, so do prices, and consequently banks raise their interest rates as well to cope and maintain their profit margin. Higher interest rates often cause unemployment to rise. In certain scenarios, rising prices can also mean more panicky spending and consumption among end users, causing debt and poverty. The extreme version of this is called hyperinflation: A rapid increase of prices that is out of control and leads to bankruptcies en masse, devaluation of money and subsequently a currency reform, among other things. But does that mean that low inflation is better? Maybe, but only to a certain degree; the ECB, for example, aspires to maintain an inflation rate of about two percent so as to keep the economy stable. As soon as we reach deflation territory, however, things are starting to look grim again. The best course is a stable inflation rate, to avoid uncertainty and rash actions.”

Against the foregoing backdrop, it is expedient to urge our political leaders to tackle inflation. This is as Nigeria has in recent months been grappling with an unsettling rise in inflation rates, which have brought significant hardship to the lives of millions of citizens. As the cost of living soars, necessities such as food, housing, and transportation have become increasingly unaffordable for many Nigerians. It is imperative for our political leaders to take decisive action to address this pressing issue, as the welfare of the people hinges on their response to these economic challenges.

It is concerning as Inflation, which is the rate at which the general level of prices for goods and services rises, has unprecedentedly been eroding the purchasing power of consumers by each passing day. In fact, the ripple effects of inflation are being felt across all sectors of the economy. This can be seen in basic commodities, like rice, beans, and cooking oil, which have seen price hikes that strain household budgets, forcing families to make difficult choices between essential needs. Without sounding exaggerative in this context, the impact on the poorest segments of society is particularly distressing; those who already live on the margins are now pushed further into poverty.