Africa

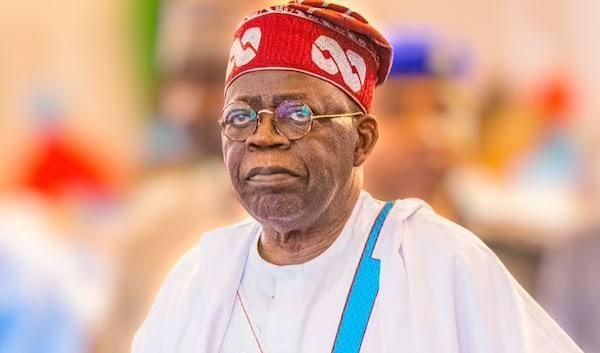

President Tinubu’s Debt Drive: A Nation’s Burning Questions -By Mohammad Aisha Jarmai

This is a resolute call for profound transformation. Citizens are openly discontented and demand another way of living. It’s a call to bring an end to the “spend and borrow” policy and start using ourselves. That entails creating more money-generating possibilities, monitoring money, putting money into the productive economy, and fostering local production.

It is clear that the majority of Nigerians are worried that the government led by President Bola Ahmed Tinubu still keeps borrowing more. Even though we already have a mountain of debt, talking about borrowing more makes people concerned with the future of our country and how it affects common Nigerians.

This is the question on everyone’s lips. Nigeria spends a lot of natural resources, such as oil, and a very large population that can earn a great deal of money for Nigeria. In 2023 alone, our states and FCT accounted for N2.43 trillion from our own resources. Why then do we always borrow? Government will always say we simply don’t have money at home and must fix our roads, power, and hospitals. Though these initiatives are essential, constantly having to borrow, even when we borrow with our own money, is a sign that something has gone wrong. Are we really using our own money wisely before we turn to other people for help?

This is the sour truth for most Nigerians. When the government borrows money, it’s borrowed back using public funds – tax money and other things that affect us personally. Nigeria’s debt, according to experts, could hit a staggering N180 trillion by 2026. Most of our government’s income (over 80% in some cases) is already going towards simply meeting maturity obligations. This leaves us with not much for critical services like healthcare and education. So, the question of when we’ll finally finish paying is an infinite story. Is it only that ordinary people ought to suffer because of choices in which they did not get much say, especially when they do not always get the benefit of such loans?

This emotion reflects how frustrated and disappointed people are. Continuous borrowing, especially for day-to-day running costs or unproductive ventures, keeps us stagnated in a vicious circle that prevents genuine growth. If a country is highly indebted, it can be dominated by the individuals to whom it borrowed. That can limit our independence and close our choices. Are we independent if foreign lenders tell us what to do with our economy? Isn’t it a reflection that our leaders are not working hard enough when a country with so much potential is still begging for help instead of looking at how it can earn its own money, take responsibilities, and grow its industries? That makes our “Giant of Africa” title meaningless.

We call our leaders “lazy” because it is simpler to borrow than it is to discover new, long-term answers to our financial issues. This large debt harms our economy significantly, creating increased prices, weaker money, and a more difficult life for all.

This is a resolute call for profound transformation. Citizens are openly discontented and demand another way of living. It’s a call to bring an end to the “spend and borrow” policy and start using ourselves. That entails creating more money-generating possibilities, monitoring money, putting money into the productive economy, and fostering local production.

Eventually, this calls for sound leadership. Our leaders must make tough but necessary choices, put the long-term in front of the instant fix, and show by their own example how to be frugal with money. The days of quick fixes and easy answers are over. This constant borrowing is not sustainable and is not in Nigeria’s best interest. The voice of the people, asking these questions, is a call for a responsible, independent, and prosperous Nigeria, where debt no longer hinders the ambition of its people.

If necessary, I am open to revisions to align with your editorial guidelines. Please let me know if you require any additional information.

Thank you for your time and consideration. I look forward to your response.

Mohammed Aisha Jarmai

+234 813 815 2571