Economy

Urging Banks To Settle USSD Debt To Prevent Telecom Companies From Passing Costs Onto Consumers -By Isaac Asabor

In fact, the ongoing USSD debt crisis is not just an industry issue, it is a consumer issue. Millions of Nigerians depend on USSD services for financial transactions, and the rising costs of telecom services due to banks’ refusal to pay their debts is a burden they cannot afford. As inflation continues to rise, and Nigerians struggle with the high cost of living, it is only fair that banks step up and clear their outstanding obligations.

The prolonged financial dispute between Nigerian banks and telecom providers over unpaid USSD fees has reached a crisis point. Telecom operators, including MTN, Airtel, Glo, and 9mobile, are owed a staggering N250 billion by banks, a debt that has accumulated over six years. This unresolved issue threatens not only the financial viability of USSD services but also places additional cost burdens on consumers through increased telecom tariffs.

To say that it is a growing debt crisis cannot be pooh-poohed by mere waves of the hands as the USSD debt issue dates back to 2019, when telecom companies initially reported that banks owed them N32 billion. By March 2021, the debt had grown to N42 billion, and by November 2022, it had reached N80 billion. In June 2023, the amount doubled to N120 billion, and by October 2024, the debt had exceeded N200 billion, eventually ballooning to the current N250 billion.

Despite this, banks continue to make massive profits from USSD transactions. In the first half of 2024 alone, the total value of USSD transactions reached N2.19 trillion, accounting for 45.3% of the total transaction value of N4.84 trillion recorded in 2023. While banks benefit from this service, telecom operators remain unpaid, leading to increased operational costs.

Without a doubt, the debt crisis is affecting consumers. For instance, telecom providers have been forced to raise service charges to offset their losses. The rising cost of network maintenance, coupled with the increasing prices of diesel, equipment, and other essential materials, has driven telcos to seek ways to remain profitable. This has resulted in higher call, data, and SMS tariffs, ultimately transferring the burden onto Nigerian consumers.

With inflation at 33.95% as of June 2024, and the cost of living already unbearably high, the last thing Nigerians need is a further increase in telecom service charges. Many low-income earners rely on USSD for essential transactions such as money transfers, bill payments, and airtime purchases. If telecom operators keep raising tariffs due to unpaid debts, the most vulnerable Nigerians will be priced out of financial services, undermining the financial inclusion efforts the government has championed over the years.

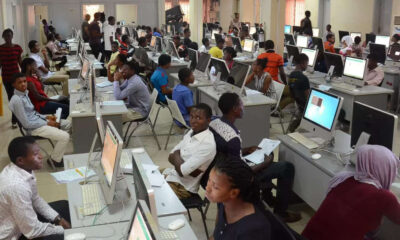

Against the foregoing backdrop, the role of USSD in financial inclusion cannot be said to have being overstated in this context. This is as USSD technology plays a critical role in Nigeria’s financial ecosystem, enabling millions of Nigerians, especially those in rural and underserved areas, to access banking services without an internet connection. According to the Nigeria Inter-Bank Settlement System (NIBSS), over 44 million Nigerians use USSD-based banking services regularly.

For many Nigerians without smartphones or internet access, USSD is the only means of accessing financial services. If telecom operators continue to raise tariffs, the cost of performing simple banking transactions will increase significantly, discouraging many from using formal banking channels. This could push more people into the informal cash-based economy, reversing the progress made in driving financial inclusion.

At this juncture, it is expedient to ask about the way forward. To not a few Nigerians, particularly those who are conversant with the issue, regulatory interventions is the way forward.

It will be recalled at this juncture that the Nigerian Communications Commission (NCC) and the Central Bank of Nigeria (CBN) have made several attempts to mediate between banks and telecom operators. In May 2023, when the NCC granted telecom providers permission to disconnect banks from USSD services due to non-payment of debts. However, this move was reversed after CBN intervention.

Despite regulatory efforts, banks have yet to clear their debts. As the imbroglio seemingly remains irresolvable, it is not a misnomer to opine that there is a pervading fear among Nigerians that telecom operators might be forced to suspend USSD services entirely, affecting millions of Nigerians who depend on it for financial transactions.

Without a doubt, it would be a huge relief for consumers if banks pay the debt as soon as possible as the debt is a growing debt that keeps mounting by each passing day.

If banks fulfill their financial obligations and settle the N250 billion debt, it would provide immediate relief to telecom operators, allowing them to stabilize or even reduce tariffs. This would directly benefit Nigerian consumers in several ways. For instance, there would be reduced cost of transactions. This is as telecom operators would no longer struggle to compensate for unpaid debts through higher service charges. Not only that, USSD transaction costs could stabilize or even decrease, making banking more affordable for all Nigerians.

In a similar vein, there would be improved financial access for low-income earners as millions of Nigerians, particularly those in remote areas, rely on USSD for banking. Without a doubt, settling this debt would prevent further price hikes, ensuring financial services remain accessible to the most vulnerable populations.

Also, there would be enhanced banking efficiency. This is as banks also stand to benefit from continued USSD service, as it enables seamless transactions for their customers. In fact, if USSD services become too expensive or get suspended, many Nigerians would be forced to visit physical bank branches, increasing congestion and reducing efficiency.

In a similar vein, there would be increased mobile penetration and digital growth. The reason for the foregoing cannot be farfetched as Nigeria’s digital economy relies on affordable telecom services. Therefore, by settling their debts, banks can contribute to the broader goal of expanding digital access and fostering economic growth.

Given the foregoing backdrops, it will not in this context be considered a misnomer to plead to banks to act responsibly over this growing and lingering debt.

Banks must prioritize the settlement of their USSD debts to ensure the sustainability of digital financial services in Nigeria. By paying what they owe, they will not only ease the financial burden on telecom providers but also prevent unnecessary tariff hikes that hurt consumers.

As financial institutions benefiting from the USSD ecosystem, banks have a moral and financial responsibility to support the system that has helped drive financial inclusion across Nigeria. Failure to do so may lead to service disruptions, higher telecom tariffs, and greater financial exclusion for Nigerians.

In fact, the ongoing USSD debt crisis is not just an industry issue, it is a consumer issue. Millions of Nigerians depend on USSD services for financial transactions, and the rising costs of telecom services due to banks’ refusal to pay their debts is a burden they cannot afford. As inflation continues to rise, and Nigerians struggle with the high cost of living, it is only fair that banks step up and clear their outstanding obligations.

The CBN, NCC, and other regulatory bodies must ensure full compliance and hold banks accountable for settling this debt. Only then can telecom operators operate without passing unnecessary costs onto consumers, and only then can Nigerians continue to access affordable financial services.

Without resort to exaggerating the issue, it is expedient banks act now before the situation worsens. The longer they delay, the more Nigerian consumers will suffer. It is time for banks to pay up and ease the burden on telecom providers and consumers alike.