Africa

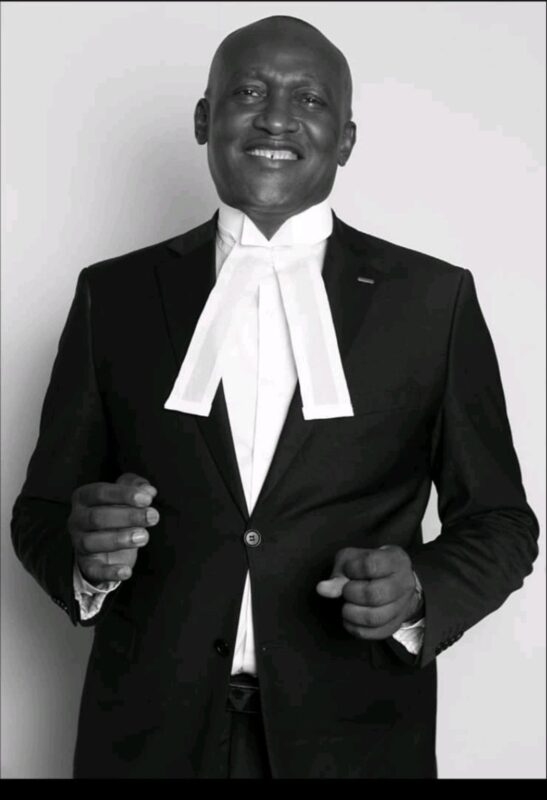

Balancing Effective Enforcement Of Money Judgments With Judgment Debtor’s Rights In Nigeria -By Ishie-Johnson Emmanuel Esq.

Enforcing money judgments in Nigeria demands a nuanced balance between robust execution and safeguarding judgment debtors’ rights. Though current limitations persist, targeted reforms—legislative, institutional, and procedural—offer pathways to an efficient debt recovery system upholding interests of creditors and debtors alike.

ABSTRACT

Enforcing money judgments in Nigeria remains contentious, as the drive for effective execution often conflicts with safeguarding judgment debtors’ rights. This article analyzes Nigeria’s legal framework in reconciling these interests, spotlighting challenges judgment creditors face—especially against government agencies—and risks of abuse by law enforcement or debt collectors. It proposes reforms, including updates to the Sheriffs and Civil Process Act, enhanced training for court bailiffs, and stronger oversight mechanisms.

INTRODUCTION

Enforcing money judgments forms a cornerstone of Nigeria’s judicial process, ensuring courts’ determinations of rights and obligations are effectively realized. Yet, this process faces significant hurdles, particularly in balancing robust enforcement with safeguarding judgment debtors’ rights. This article assesses Nigeria’s legal framework in addressing these tensions and advances targeted recommendations for reform.

CHALLENGES IN ENFORCING MONEY JUDGMENTS

Enforcing money judgments in Nigeria presents formidable legal, institutional, and systemic obstacles that undermine judicial efficacy.

Legal Challenges

• Attorney-General’s Consent: Requiring the Attorney-General’s consent for judgments against government agencies creates major delays and bureaucratic impediments, often thwarting creditors’ debt recovery.

• Garnishee Proceedings: These proceedings falter due to secrecy shrouding government accounts and challenges in tracing public funds.

Institutional Challenges

• Corruption: Rampant corruption among court officials and enforcement agents enables bribery and process manipulation, eroding enforcement integrity.

• Inadequate Resources: Insufficient funding and logistics cripple the execution of court orders.

Systemic Issues

Systemic flaws exacerbate enforcement difficulties, including protracted delays, weak accountability, and exploitable judicial discretion.

• Delays: Court congestion, bureaucratic procedures, and abusive appeals prolong enforcement, frustrating creditors.

• Lack of Accountability: Government agencies routinely flout judgments amid a culture of non-compliance.

• Judicial Discretion: Debtors exploit discretionary powers to evade or defer payments.

Proposed Reforms

Stakeholders advocate targeted reforms to bolster enforcement while curbing abuses:

• Sheriffs and Civil Process Act Amendments: Modernize procedures by excising outdated provisions.

• Enhanced Transparency and Accountability: Mandate government compliance and financial openness.

• Training for Court Officials: Build capacity to ensure effective, impartial execution.

PROTECTION OF JUDGMENT DEBTORS’ RIGHTS

In Nigeria, judgment debtors’ rights are enshrined in key statutes, including the 1999 Constitution (as amended) and the Federal Competition and Consumer Protection Act (FCCPA) 2018.

KEY RIGHTS OF JUDGMENT DEBTORS

Fair Hearing: Debtors are entitled to a fair hearing before any court or tribunal imposes a decision against them.

1. Legal Representation: Debtors may retain counsel throughout debt recovery proceedings.

2. Protection from Unlawful Arrest: Civil debtors cannot face arrest or detention solely for unpaid debts absent a court order or criminal conduct.

3. Shield from Harassment: Creditors and agents must refrain from threats, intimidation, or public shaming.

4. Disputing Inaccuracies: Debtors can contest errors in debt amounts or terms.

5. Privacy Safeguards: Financial details remain confidential without legal authorization.

ENFORCEMENT MECHANISMS

• Garnishee Proceedings: Courts may issue orders attaching debtors’ funds in bank accounts or assets held by third parties.

• Writ of Execution: Courts authorize seizure and sale of debtors’ movable or immovable property to satisfy judgments.

Consequences of Unlawful Debt Recovery

• Liability for Damages: Creditors engaging in illegal practices face claims for compensation.

• Abuse of Court Process: Debtors may contest enforcement actions constituting procedural abuse.

RECOMMENDATIONS

To reconcile effective enforcement of money judgments with judgment debtors’ rights in Nigeria, the following targeted reforms are proposed across legislative, institutional, procedural, protective, and capacity-building domains.

Legislative Reforms

• Amend Sheriffs and Civil Process Act: Modernize the Act to align with economic realities, technology, and global best practices in debt enforcement.

• Enact Debtors’ Protection Act: Introduce dedicated legislation safeguarding debtors’ rights and standardizing recovery practices.

Institutional Reforms

• Establish Debt Recovery Tribunal: Create a specialized tribunal for expedited dispute resolution.

• Bolster Regulatory Oversight: Enhance supervision of debt collectors and financial institutions to curb abuses.

Procedural Reforms

• Streamline Enforcement: Simplify procedures to minimize delays and costs.

• Incorporate ADR: Integrate mediation and arbitration for amicable resolutions.

Debtors’ Rights Protections

• Issue Clear Guidelines: Mandate standards for creditors’ and collectors’ interactions with debtors.

• Mandate Transparency: Require detailed account statements and enforcement notices.

Capacity Building

• Train Court Officials: Equip judges, magistrates, and bailiffs with expertise in debt laws and procedures.

• Launch Public Awareness: Educate citizens on rights, obligations, and enforcement processes.

Implementing these measures will foster a balanced, efficient debt recovery system in Nigeria.

CONCLUSION

Enforcing money judgments in Nigeria demands a nuanced balance between robust execution and safeguarding judgment debtors’ rights. Though current limitations persist, targeted reforms—legislative, institutional, and procedural—offer pathways to an efficient debt recovery system upholding interests of creditors and debtors alike.

KEY TAKEAWAYS

1. Adopt a balanced debt recovery approach prioritizing creditors’ and debtors’ interests.

2. Safeguard debtors’ rights to fair treatment, dignity, and privacy.

3. Leverage alternative dispute resolution, like mediation and arbitration, for amicable resolutions.

REFERENCES

Books

1. Aguda, T. A. (1980). The Law of Judgments in Nigeria. Lagos: University of Lagos Press.

2. Okonta, I. E. (2018). Enforcement of Judgments and Orders in Nigerian Courts. Abuja: Nigerian Institute of Advanced Legal Studies.

Journal Articles

1. Ayenakin, O., & Kolade-Faseyi, I. (2021). Enforcement of judgments in Nigeria: Issues, law and challenges. Global Journal of Politics and Law Research, 9(7), 1–15.

Newspaper Articles

1. “Judgment Won, Justice Lost: Inside Nigeria’s Broken Enforcement System.” The Nation Newspaper.

Journals

1. Journal of Law and Practice (University of Nigeria).

2. Nigerian Journal of Contemporary Law (University of Lagos).

3. Journal of African Law (SOAS University of London).

Legislation

1. Federal Competition and Consumer Protection Act (FCCPA) 2018.

2. Sheriffs and Civil Process Act.

3. Constitution of the Federal Republic of Nigeria 1999 (as amended).

Ishie-Johnson Emmanuel Esq. Writes from Ishie-Johnson and Associates

Email: emmajohnsonace@gmail.com

Phone No: 08033816237, 08023186281