Africa

New Tax Law Implementation: A pathway to achieve a prosperous Nigeria -By Adesina Julius

We must all understand that tax payment is a civic responsibility and failure to pay tax is a criminal offense. So, to have a prosperous Nigeria, let’s be patriotic in paying our tax.

The implementation of the new tax law by January 2026 is a pathway towards the prosperous Nigeria we all have been praying for.

Having a look at the advantages and benefits for all citizens, especially the vulnerable. Every patriotic Nigerian who has been an advocate for prosperous Nigeria will agree that if the new tax law is implemented, it will offer concrete relief to virtually every segment of the economy. For the most vulnerable, the changes are particularly significant. The income tax exemption threshold has been dramatically raised, meaning individuals earning up to ₦800,000 annually are now exempted from the personal income or pay as you earn (PAYE) tax. This injects disposable income directly into the hands of over 90% of low-income earners, stimulating consumption and grassroots economic activity.

Over the years, the small and medium-sized enterprises (SMEs) have long been hailed as the backbone of the economy and have received their most significant support in decades. Imagine with the new tax reform, businesses with an annual turnover of up to ₦50 million are now exempt from Company Income Tax (CIT), Value Added Tax (VAT), and withholding tax.

Such an act is a powerful incentive for formalization and growth, freeing up vital capital for reinvestment, expansion, and job creation.

In addition, the reform gives larger corporations the headline corporate tax rate, which is set to drop from 30% to a more competitive 25%, signaling to both domestic and international investors that Nigeria is serious about improving its business climate.

Furthermore, the explicit removal of VAT from essential goods and services—including food, educational items, healthcare, rent, and public transport—directly addresses the cost-of-living crisis and eases the burden on all citizens.

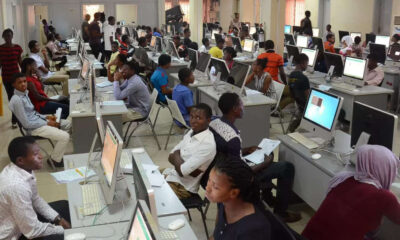

The new reform is also a technology-driven reform, moving from an analog way to a digital way of collecting tax. This technology drive is a means to simplify tax processes, drive voluntary tax compliance, increase revenue collection, and create a tax environment that is conducive for taxpayers to fulfill their tax obligations.

This is the renewed hope Nigerians have been waiting for. The changes are here; these reforms give us the chance to do things right!

We must all understand that tax payment is a civic responsibility and failure to pay tax is a criminal offense. So, to have a prosperous Nigeria, let’s be patriotic in paying our tax.

Nigeria must work; this is the vision we have held onto for so long, and it is a collective work.

Adesina Julius Is a Tax advocate and Tax enforcement Officer.