Africa

Punishment In The Guise Of Recovery: Why Nigerians Should Not Be Burdened With More Taxes -By Isaac Asabor

Taiwo Oyedele’s clarifications may sound convincing on paper, but they miss the human dimension. Nigerians are not worried about legal harmonization or ministerial orders; they are worried about survival. At a time when inflation is high, poverty is deepening, and wages are stagnant, a fuel surcharge is not recovery. It is punishment disguised as reform, and Nigerians deserve far better than that.

Work has always been hard. To farm, to trade, to build, to teach, to run businesses, all demand sweat, energy, and determination. Work is taxing, but nobody calls it wrong because it produces value, dignity, and sustenance. Taxation too, when applied fairly and wisely, is not inherently wrong. Governments everywhere tax their citizens to fund schools, roads, hospitals, and security. Citizens, in turn, expect accountability and tangible benefits.

But taxation becomes oppressive when it is imposed on a people already broken by economic hardship. At that point, it is no longer policy, it is punishment. In Nigeria today, citizens are not merely taxed; they are literarily flogged under the guise of economic recovery.

On September 6, 2025,Taiwo Oyedele, Chairman of the Presidential Fiscal Policy & Tax Reforms Committee, attempted to defend the controversial 5% fuel surcharge. In a lengthy post on X, he argued that the surcharge is not new but already exists under the Federal Roads Maintenance Agency (FERMA) Amendment Act of 2007. According to him, its inclusion in the new Tax Act is only for harmonization, and that actual implementation will depend on when the Minister of Finance issues an order.

His explanation was polished, but it failed to strike at the heart of Nigeria’s economic reality: every additional tax or surcharge, new or old, harmonized or delayed, translates into higher prices for transport, food, and daily survival. In a country where headline inflation still stands at 21.88% (July 2025, NBS), with food inflation at 22.74% and over 54% of the population living in poverty according to the World Bank, talking about new levies is not reform. It is punishment.

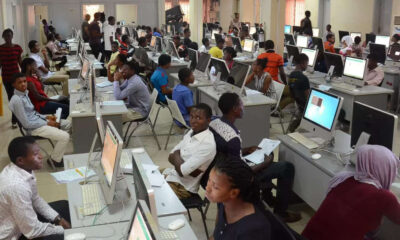

There is a difference between being taxed by nature of work and being punished by leaders through reckless economic policy. Nigerians are not lazy. Farmers cultivate despite insecurity in rural areas. Traders keep shops open despite epileptic power supply. Civil servants and private workers endure inadequate pay, long commutes, and inflation yet press on. These are the ordinary taxes of life.

But when government adds financial burdens without cushioning, taxation becomes oppression. Like the Israelites in Pharaoh’s Egypt, Nigerians today are made to build bricks without straw, working harder while receiving less.

At this juncture, it is germane to throw insight into the reasons why Oyedele’s clarifications do not hold Water

First and foremost is that he said “It’s not a new tax.” And that is technically true, but meaningless to struggling citizens. If a law exists but has never been enforced, then activating it now amounts to introducing a new tax. Nigerians feel effects in their pockets, not in statutes.

He said, “It will only commence when the Minister gives the order.” This is no comfort. Once a tax is enshrined in law, its implementation is inevitable. Nigerians already anticipate its commencement in January 2026, making the delay a ticking time bomb, not a relief.

He clarified in that “Several fuels are exempt.” He explained that Kerosene, LPG, and CNG may be exempt, but petrol is the lifeblood of Nigeria’s economy. Transport, food, manufacturing, education, virtually everything depends on it. Exemptions do little to shield the masses.

He assured that “The surcharge will fix roads.” This is the weakest argument of all. Nigerians have heard such promises for decades. Potholes remain, bridges collapse, and billions of dollars in infrastructure loans vanish into thin air. Without trust and accountability, dedicated funds sound like dedicated lies.

He also stated that “Other countries charge higher.” In my view, it is a false comparison as those countries provide efficient public transport, functioning healthcare, and social safety nets. Nigerians get none of these. To compare our hardship to their structured systems insults the intelligence of citizens already battered by poverty.

Looking at the brutal data the government ignores, it suffices to opine that Nigerians are not opposing taxes out of ignorance. They oppose them because their backs are already breaking. This is as inflation, according to NBS reports, show headline inflation at 21.88% in July 2025, down from 33.40% a year earlier, but still brutal for households. Food inflation remains high at 22.74%, meaning basic staples are beyond the reach of millions. Worse, month-on-month inflation climbed to 1.99%, proving prices continue to rise daily.

On poverty level, the World Bank estimates that 54% of Nigerians now live in poverty, with 75.5% of rural Nigerians trapped in deprivation. That is more than half the population unable to afford basic human needs.

Buttressing this piece from the perspective of unemployment and low wages, it will not be out of place to opine that many who still work earn below subsistence wages, often less than ₦70,000 per month, while food baskets cost multiples of that. The foregoing fact can be bolstered by making reference to the fact that the Nigeria Labour Congress (NLC) and federal government workers recently demanded an urgent review of the national minimum wage, insisting that the current ₦70,000 is no longer sustainable.

Given the backdrop of the facts that are inherent in the foregoing view, it is germane to opine that layering a 5% fuel surcharge on top of this reality is not fiscal reform, it is economic cruelty. Without resort to sounding censorious in this context, it is exigent and expedient for the government to embark on the journey of economic recovery that should be driven by a human face.

Governments that punish their people in the name of reforms forget a basic truth: recovery that kills the people is no recovery at all. If reforms are necessary, they must be sequenced with empathy, this means freezing new taxes until inflation subsides and wages catch up as well as slashing wasteful government spending, particularly bloated allowances for political office holders.

Not only that, government should make account for existing revenues available, show citizens real, verifiable projects funded by their taxes as well prioritize productivity, not revenue extraction. It should invest in power, agriculture, and small businesses as well as expand social protection, cushion vulnerable groups before loading them with surcharges.

To grasp the kernel of this piece, it is germane to opine that work will always be taxing. Taxes, too, will always pinch. But in just societies, both work and taxation are meaningful because they yield reward. In Nigeria today, work produces little, and taxes yield nothing but more hardship.

Again, Taiwo Oyedele’s clarifications may sound convincing on paper, but they miss the human dimension. Nigerians are not worried about legal harmonization or ministerial orders; they are worried about survival. At a time when inflation is high, poverty is deepening, and wages are stagnant, a fuel surcharge is not recovery. It is punishment disguised as reform, and Nigerians deserve far better than that.