Communication is the bloodstream of modern society. When access to it becomes exploitative, the cost is paid not only in naira but in opportunity, dignity, and...

Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective,...

Nigeria’s rising loan defaults are not merely an economic statistic; they are a governance signal. They reflect a system under stress, yes, but also one still...

When those who occupy Nigeria’s corridors of power sit to devise means of dealing with the mass murmur of discontent concerning the new tax laws, they...

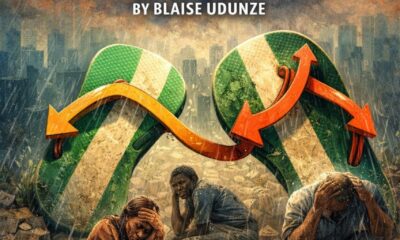

Nigeria faces an undeniable choice. It can continue down a path where fragile policies deepen deprivation and erode trust, or it can build a disciplined, coordinated...

The Nigeria Tax Act 2025 and companion statutes, effective January 1, 2026, consolidate Nigeria's tax regime to enhance efficiency, transparency, and accountability—offering SMEs exemptions from CIT...

If the government is serious about improving voluntary compliance, it must go beyond policy announcements. Hence, must demonstrate transparent use of tax revenues, strengthen oversight institutions,...

But resilience should not be mistaken for comfort. The hardship is real, and it is deep. Until economic reforms bring relief to the streets and food...

In a normal democracy, taxation without representation should never be tolerated. They must be voted out of office. We have a responsibility and duty to use...

Tax law implementation in Nigeria is not just about collecting revenue; it is about building a system that citizens trust, understand, and willingly support. When well...