Africa

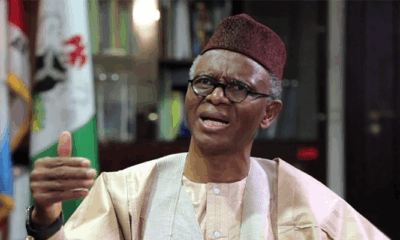

5% Fuel Surcharge Will Add More Hardship -By Abba Dukawa

The Renewed Hope of the administration should diversifying the economy to enhance other sector performance not to shift the burden onto ordinary citizens under the guise of reform. Already, the Renewed Hope has turned into Renewed Anger as millions of households are battling for survival.

In circumstances like Nigeria , where economic challenges and living costs are already weighing heavily on many people, yet the administration’s economist experts aren’t fully considering the impact on citizens

Talking straight without sugarcoating, for citizens , the past two years of the administration have been a tough struggle for survival, adding a fuel surcharge on top of that could really hurt the folks struggling to make ends meet.PBAT’s administration’s economic policies have been criticized for worsening living conditions for millions citizens.

Since President removed the petrol subsidy on his Inauguration Day (May 29, 2023), coupled with the subsequent devaluation of the naira, ordinary Nigerians have faced relentless challenges. Critique of “Tinubunomics”: The Financial Times Published July 16 2024, described Tinubu’s economic policies as “disjointed” and warned that “shock therapy will probably fail if important adjustments are not made.

Why 5% Fuel Surcharge will add more hardship:

For a population already stretched to its limits, any further increase in petroleum product prices is nothing short of rubbing salt into an open wound. Totally agree! introducing a 5% fuel surcharge set to takes effect from January 1st, 2026 on locally produced and imported petrol and diesel in the country sounds like a really tough pill to swallow considering Nigerians are already dealing with economic uncertainty , and widespread hardship the new tax law, is untimely and fundamentally unjust.

With a five percent fuel surcharge being an additional fee imposed by transportation companies, to cover the fluctuating costs of fuel. Therefore, citizens will receive the end result as prices in everything skyrocket will affect everything from medical expenses, school fees, to telecom services and electricity tariffs the surcharge will hit household budgets hard.

As result of fuel subsidy removal monthly allocations to states and local government areas have increased by 62 percent annually since 2023 despite this improvement there was abundant suffering because the monies channeling to states went to drain. The administration also claimed it has saved about $600 million however the administration still sought local and international loan like there is no tomorrow.

But the thing to look at is why the government is imposing more tax on ordinary citizens . The need for boosting non-oil revenue and promoting fiscal sustainability rings hollow , given the severe toll this policy will take on families , small businesses, and the working poor. The administration’s focus on revenue generation, seemingly indifferent to the struggles of ordinary people, borders on mercilessness.

So why are Nigerians being taxed further? This defeats the purpose of the tax reforms to reduce the incidence of multiple taxation. While the government projects a N796 billion windfall from this surcharge, it comes at the expense of consumers already suffocating under high inflation, food insecurity, and rising transportation costs.The rationale that these taxes promote fiscal sustainability is weak, especially considering that recent tax reforms were designed to broaden compliance, close revenue leaks, and expand the tax base.

For an administration that claims “Renewed Hope” as its central theme, some of it’s economic policies demonstrates a lack of concern for others’ feelings. The new tax is a breached of that promise.

If the government truly wants to raise more revenue from the oil sector, it should answer persistent calls for accountability, enforce fiscal discipline, and plug systemic leakages within the NNPC and other revenue-generating agencies. It should focus on boosting oil production, selling the bankrupt refineries.

Therefore, the government must rethink the particular 5% Fuel Surcharge and expunge it from the tax act. Revenue generation cannot come at the expense of social justice. Fiscal reforms should aim to uplift, not further impoverish, the very citizens the government is meant to serve.

The Renewed Hope of the administration should diversifying the economy to enhance other sector performance not to shift the burden onto ordinary citizens under the guise of reform. Already, the Renewed Hope has turned into Renewed Anger as millions of households are battling for survival..

Dukawa write it from Abuja can be reached at abbahydukawa@gmail.come